Tax breaks, also know as federal tax spending, includes things like mortgage deductions, child tax credits and lowered tax rates on capital gains. The CBO published a report today on what these deductions and tax breaks cost the federal government in annual revenues. The total amount is enormous. The top 10 most revenue syphoning tax cuts (there are more than 200 tax deductions in all) cost $900 billion. Tax spending is greater than budge expenditures for Medicare, Defense, or Social Security. It equals 1/17th of the US economy (or GDP). But taxbreaks or loopholes don't show up anywhere in the federal budget, so the relative size of these hidden expenses are not usually apparent. They don't often make it into the national dialogue when we talk about the budget. Below is the CBO report summary.

congressional budget office

supporting the congress since 1975

The Distribution of Major Tax Expenditures in the Individual Income Tax System

report date: May 29, 2013

read complete document (pdf, 296 kb)

A number of exclusions, deductions, preferential rates, and credits in the federal tax system cause revenues to be much lower than they would be otherwise for any given structure of tax rates. Some of those provisions—in both the individual and corporate income tax systems—are termed “tax expenditures” because they resemble federal spending by providing financial assistance to specific activities, entities, or groups of people. Tax expenditures, like traditional forms of federal spending, contribute to the federal budget deficit; influence how people work, save, and invest; and affect the distribution of income.

This report examines how 10 of the largest tax expenditures in the individual income tax system in 2013 are distributed among households with different amounts of income. Those expenditures are grouped into four categories:

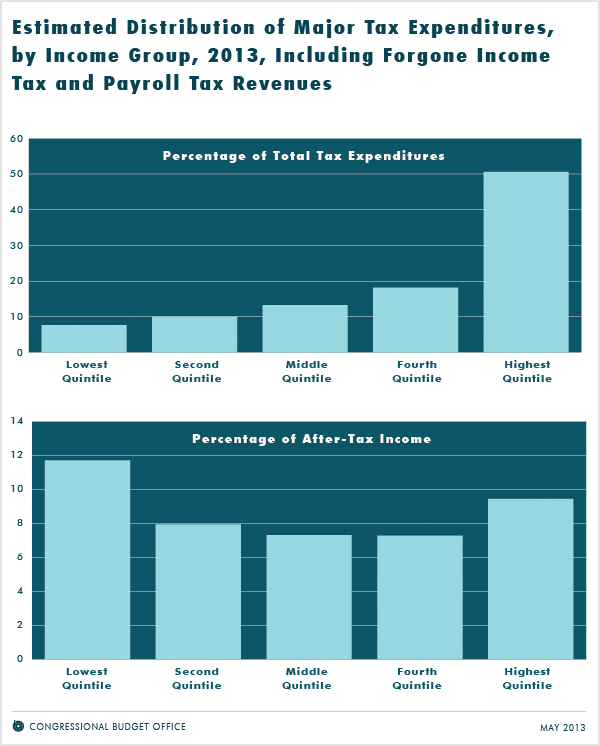

When measured relative to after-tax income, those 10 major tax expenditures are largest for the lowest and highest income quintiles. In calendar year 2013, CBO estimates, the combined benefits will equal nearly 12 percent of after-tax income for households in the lowest income quintile, more than 9 percent for households in the highest quintile, and less than 8 percent for households in the middle three quintiles (see the bottom panel of the figure above).

The distribution of tax expenditures across the income scale varies considerably among the different tax expenditures. For example, CBO estimates that more than 90 percent of the benefits of reduced tax rates on capital gains and dividends will accrue to households in the highest income quintile in 2013, with almost 70 percent going to households in the top percentile. Those benefits will equal 2 percent of after-tax income for the highest quintile and 5 percent of after-tax income for households in the top percentile. In contrast, about half of the benefits of the earned income tax credit will accrue to households in the lowest income quintile, equaling 6 percent of after-tax income for households in that group.

Tax credits that will provide assistance in paying premiums in health insurance exchanges are excluded from the distributional results presented here because they are not in effect in 2013. When those tax credits come into effect, they will appreciably increase tax expenditures for households in the lower and middle income quintiles. Individuals and families who have income between 100 percent and 400 percent of the federal poverty guidelines and who meet certain other requirements will be eligible for those credits.

This report examines how 10 of the largest tax expenditures in the individual income tax system in 2013 are distributed among households with different amounts of income. Those expenditures are grouped into four categories:

- Exclusions from taxable income—

- Employer-sponsored health insurance,

- Net pension contributions and earnings,

- Capital gains on assets transferred at death, and

- A portion of Social Security and Railroad Retirement benefits;

- Itemized deductions—

- Certain taxes paid to state and local governments,

- Mortgage interest payments, and

- Charitable contributions;

- Preferential tax rates on capital gains and dividends; and

- Tax credits—

- The earned income tax credit, and

- The child tax credit.

How Do Tax Expenditures Affect the Federal Budget?

Although the 10 major tax expenditures listed here represent a small fraction of the more than 200 tax expenditures in the individual and corporate income tax systems, they will account for roughly two-thirds of the total budgetary effects of all tax expenditures in fiscal year 2013, CBO estimates. Together, those 10 tax expenditures are estimated to total more than $900 billion, or 5.7 percent of gross domestic product (GDP), in fiscal year 2013 and are projected to amount to nearly $12 trillion, or 5.4 percent of GDP, over the 2014–2023 period. In addition, tax credits to subsidize premiums for health insurance provided through new exchanges to be established under the Affordable Care Act will represent a new tax expenditure beginning in 2014, estimated to equal 0.4 percent of GDP over the 2014–2023 period.How Are Tax Expenditures Distributed Among Households?

The 10 major tax expenditures considered here are distributed unevenly across the income scale. In calendar year 2013, more than half of the combined benefits of those tax expenditures will accrue to households with income in the highest quintile (or one-fifth) of the population (with 17 percent going to households in the top 1 percent of the population), CBO estimates. In contrast, 13 percent of those tax expenditures will accrue to households in the middle quintile, and only 8 percent will accrue to households in the lowest quintile (see the top panel of the figure below).

When measured relative to after-tax income, those 10 major tax expenditures are largest for the lowest and highest income quintiles. In calendar year 2013, CBO estimates, the combined benefits will equal nearly 12 percent of after-tax income for households in the lowest income quintile, more than 9 percent for households in the highest quintile, and less than 8 percent for households in the middle three quintiles (see the bottom panel of the figure above).

The distribution of tax expenditures across the income scale varies considerably among the different tax expenditures. For example, CBO estimates that more than 90 percent of the benefits of reduced tax rates on capital gains and dividends will accrue to households in the highest income quintile in 2013, with almost 70 percent going to households in the top percentile. Those benefits will equal 2 percent of after-tax income for the highest quintile and 5 percent of after-tax income for households in the top percentile. In contrast, about half of the benefits of the earned income tax credit will accrue to households in the lowest income quintile, equaling 6 percent of after-tax income for households in that group.

Tax credits that will provide assistance in paying premiums in health insurance exchanges are excluded from the distributional results presented here because they are not in effect in 2013. When those tax credits come into effect, they will appreciably increase tax expenditures for households in the lower and middle income quintiles. Individuals and families who have income between 100 percent and 400 percent of the federal poverty guidelines and who meet certain other requirements will be eligible for those credits.

No comments:

Post a Comment

Please feel free to comment or make suggestions