Imagine owning a small manufacturing business with 25 happy employees. After paying overhead , suppliers, employees, benefits and your Potter's Bank business loan you have just enough to get by.

One day your suppliers find they can't get raw materials because of artifical shortages and price spikes caused by futures speculators that work at bank. The suppliers they need to borrow money to pay for higher priced raw materials, at least until they can adjust with worker layoff and cutbacks. Potter's Bank charges them higher interest rates because now they're "risky" borrowers.

Your suppliers must pass along their higher costs to you, so now its your turn to cut wages, benefits and hours. Your employees grumble and can't keep up with the workload. Production stalls, but also sales start to drop because all the affected workers are also your customers.

One day you discover you can't pay the bank loan, so you go to Potter's Bank to renegotiate terms. Potter tells you what he has been telling everyone:

"You're a credit risk! Your workers make too much and the cost of their benefits is rising. Cut benefits, cut wages, layoff some of those lazy workers and you will be more efficient. Only then will I loan you the money you need. Do as I ask or Ill raise your interest rates further or foreclose on your business."

This is the austerity trap. Bankers use their leverage to play both ends against the middle forcing both businesses and governments to be more labor efficient. It squeezes more production out of fewer workers for lower wages and benefits. It also suppresses consumption because fewer consumers are employed and those who work have less income or job security. It doesn't matter if austerity is imposed on businesses or the public sector, the effects are the same.

Imposing austerity is like digging a hole in the economy, the more you dig the deeper the hole. It is good for bankers but bad for workers. It increases corporate profits but reduces personal incomes (except for the very rich). It shrinks the size of government but reduces support to the poor and unemployed people it creates. What ever hurts workers hurts consumers which suppresses consumption and depresses the economy, which then hurts more workers in a literally vicious cycle.

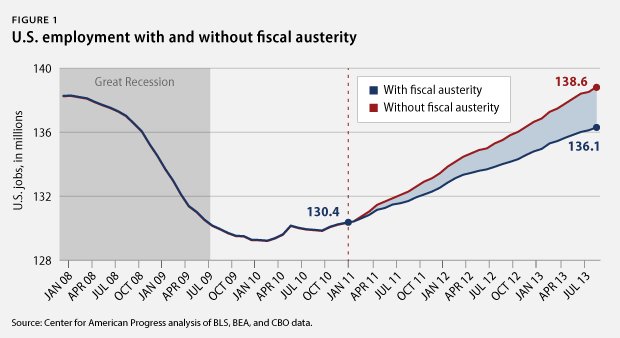

Making debt reduction a priority during a recession, rather than creating jobs and putting money back into the hands of consumers, is austerity. As the article below points out with a graph, shutting down the government and causing the government sequester to lower government spending at this time has hurt recovery. It is the wrong prescription.

In a World Without Austerity…

By Adam Hersh | October 4, 2013

Thanks to the federal government shutdown, there is an absence of new U.S. job market data for September 2013. Let’s take a moment to imagine the kind of economy we might see in the United States today had we not just lived through three years of fiercely divisive politicking for fiscal austerity—sharp cuts to public services and investments, as well as cuts to taxes on America’s wealthiest people.

If federal and state governments had not adopted policies of fiscal austerity, today’s jobs report from the Department of Labor would likely be telling us, as shown in Figure 1:

- U.S. employers added more than 260,000 jobs in September.

- The unemployment rate for September fell below 6 percent.

- Since December 2010, the U.S. economy has added more than 8.2 million new jobs—or 2.4 million more than have actually been added.

No comments:

Post a Comment

Please feel free to comment or make suggestions